UnNews:Professor says Brexit is a red herring

| We have met the enemy, and he is us | ✪ | UnNews | ✪ | Wednesday, February 18, 2026, 18:05:59 (UTC) |

| Professor says Brexit is a red herring |

|

20 June 2016

LONDON -- A scientific paper claims that the key problem facing European markets is not Brexit but the mounting problems in the banks, which have spent most of their money on MEPs' coke-fueled “team-building” fortnights on Russian billionaires' megayachts in Monaco, and the rest on keeping the Retsina flowing freely around their stunning holiday homes, nestled among the glistening white sandy coasts of the Greek Islands.

In the run-up to Britain's referendum on 23 June on whether to leave the European Union, Treasury was tasked with modelling the post-Brexit economy. George Osborne claimed that a Brexit vote could cost every household the price of a new bathroom, while at the same time telling the BBC to double up on broadcasting home improvement shows.

While econometric models comprise garbage in, garbage out, the Treasury must be authoritative and trusted, just like elected ministers' expense claims. However, a paper by Professor David Blake of the Cass Business School asserts "extraordinary abuse of economic models in the EU Referendum debate", and terms the two Treasury reports the Chancellor relied on as "dodgy dossiers," surely leading to yet another Middle East war. Professor Blake suggests that, if the models had not found a high cost to leaving, the result would have not been published and Mr Osborne would instead have forecast starvation and directed the Beeb to broadcast more bake-offs.

The paper says officials who stand to lose credibility, juicy bonuses, or column-inches over a change in the polls will tell porkie pies. Shifting rhetoric, even when based on firm econometric models, will continue to shift, as the official simply picks a different model — even if she offers her bare chest to support the party line. The paper says the scare tactics used by Government in the first referendum have begun to smell like a long-dead rat, although the same goes for other Government initiatives, especially those lucrative Private Financial ones.

Mr Osborne has admitted that the Treasury is working with the Bank of England on Brexit contingency plans, but seems to have no plan to save the careers of cabinet ministers in the event of a Remain vote, as the establishment currently expects, though Professor Blake states that the belief that Britain can influence European policy is tommyrot. The mere existence of the referendum has already put Brussels on notice that the British view them as pocket-lining dictators, whose sole purpose is to create a United States of Europe, intent on taking full control of lawmaking without the drag of having to run ballots or table negotiations.

Like North Korea, but unlike Iran, democracy in the EU is explicitly unconstitutional. Jean-Claude Junkers, President of the European Commission said, "There can be no democratic choice against the EU treaties," and Celia Messerschmitt, the EU Commissioner for Trade, said "I don't take my mandate from grubby voters." Britain is easily out-voted in the Council of Ministers, having only 13% of the votes, and the Franco-German duopoly will ensure Britain is forever side-lined on policy issues regarding Bordeaux and bratwurst, with Britain's opt-outs unlikely to protect it.

British voters, by comparison, are more concerned about being blown up in ASDA by foreigners; the imminent collapse of the NHS, education, the housing market, and society in general; and contracting cancer from imported milk. Consequently, they are shifting toward Brexit as the least contentious result, since government persuaded the UK that the Common Market was just like a Sunday car-boot sale, charging perhaps just a fiver at the gate, in order to make it vastly easier to sell a few carrots in Croatia.

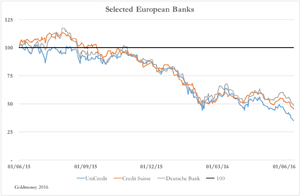

The Professor's paper suggests that the gathering worthlessness of European investments relates less to Brexit than to the gathering worthlessness of Europe: Given the EU’s fiscal policy of “party as if there is no tomorrow,” none of the core Eurozone states can stand on their own. Germany's entire private-sector savings has been sunk into France, Italy, Spain, Portugal and Greece, where there are low interest rates and even lower interest in repayment. Italy, a perennial basket case, carries private bank loans of nearly 20% of GDP, as Italian voters will not be seen dead in public without Alexander Amosu suits or Stuart Weitzman high heels — even if working on a building site. Shares of UniCredit, Credit Suisse and Deutsche Bank have become as cheap as a bowl of mascarpone.

Whatever the outcome of the Brexit referendum this week, nothing can stop a systemic crisis developing in Europe. This means that returning to the trees is inevitable; it’s just whether it will be Brits up oak trees or Europeans getting the birch.

Sources[edit]

- Alasdair Macleod "Brexit Is Getting The Blame". Seeking Alpha.com, June 20, 2016